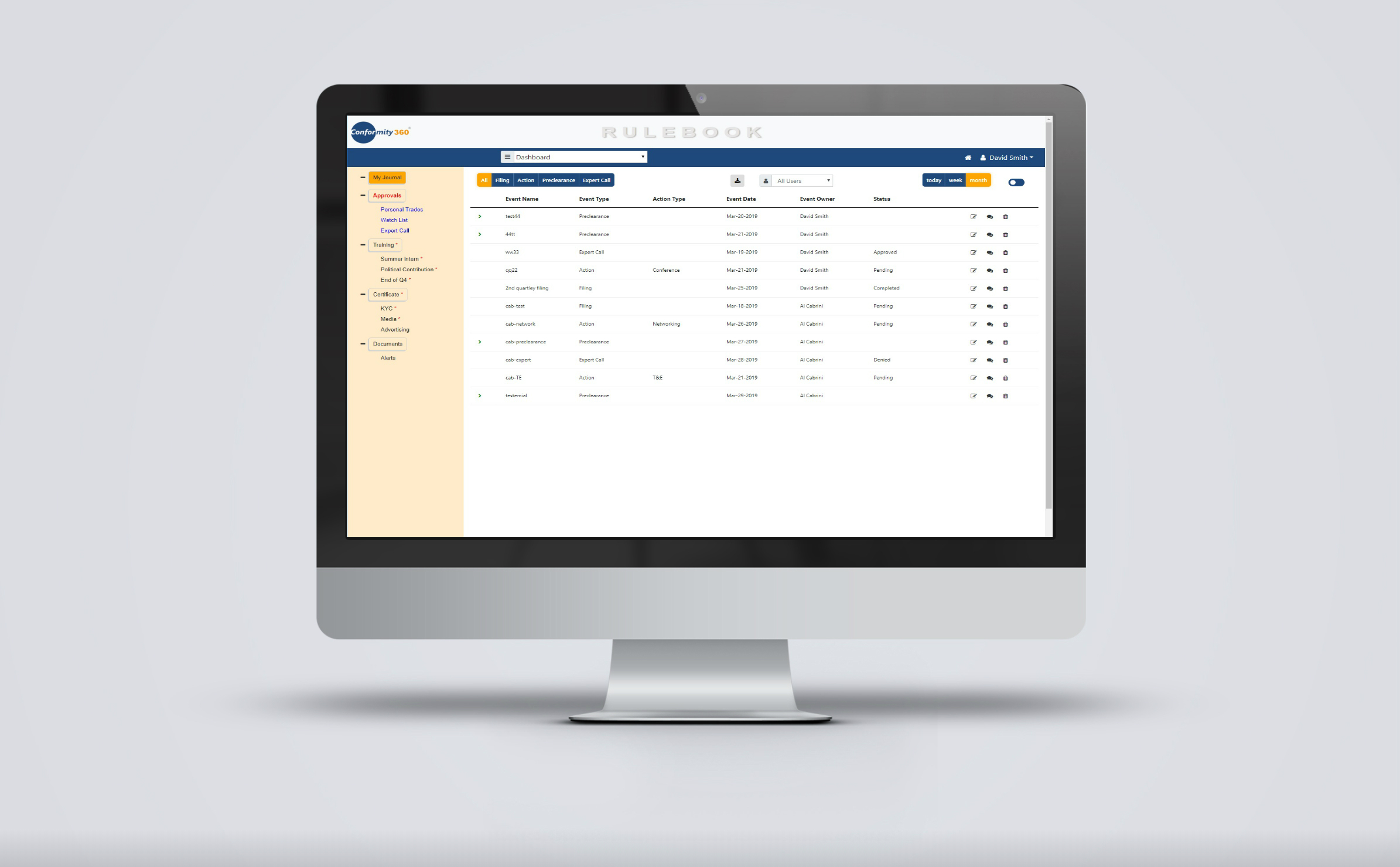

RuleBook

Considering the increasing volume and complexity of regulations a major concern of any hedge fund or investment manager is that the compliance function is being managed. In this demanding regulatory environment, it can be challenging to stay up-to-date on regulatory changes, and manage the entire regulatory content. Buy-side financial firms are striving to become more effective and efficient in tracking and managing regulatory changes, both in US and non-US markets.

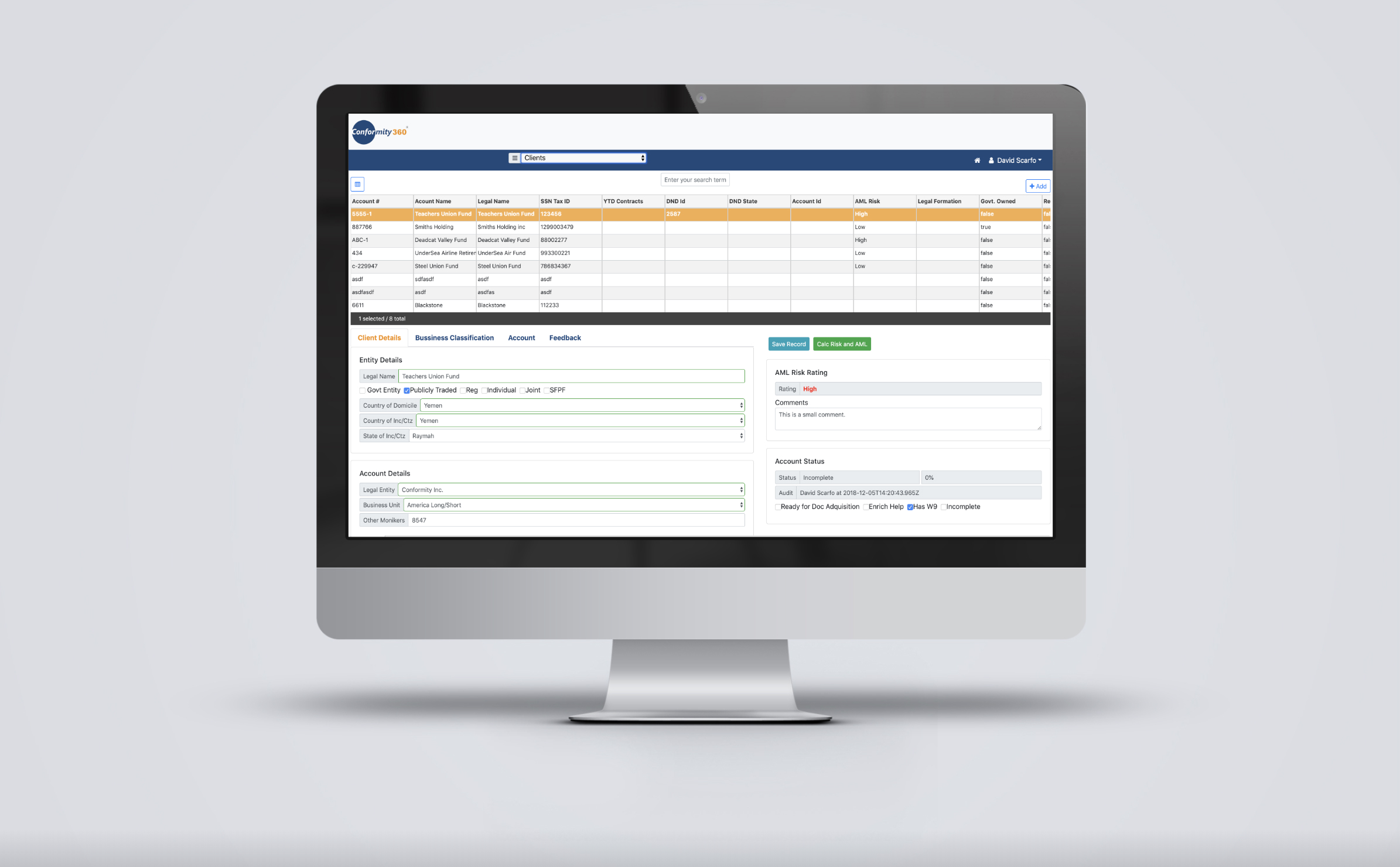

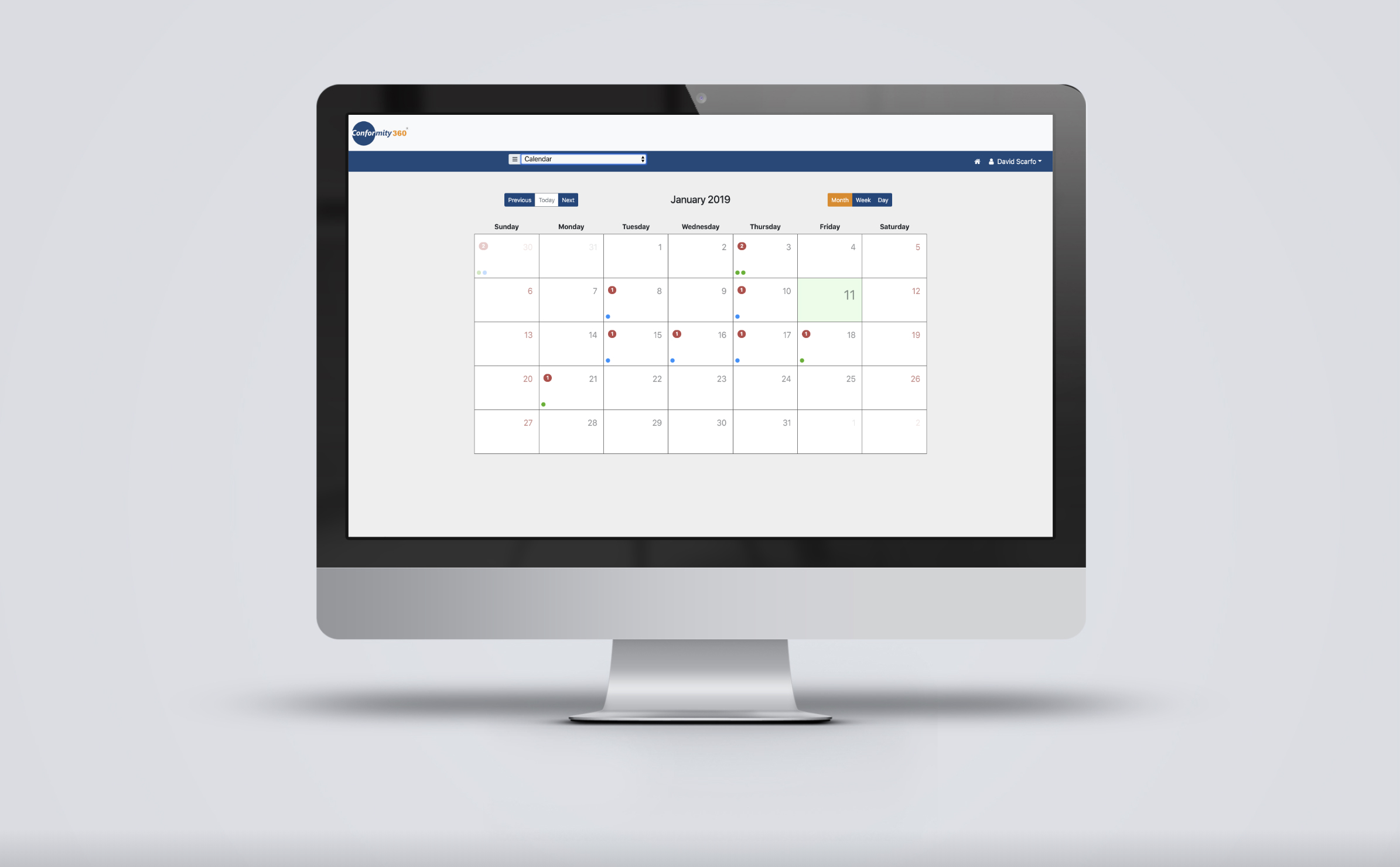

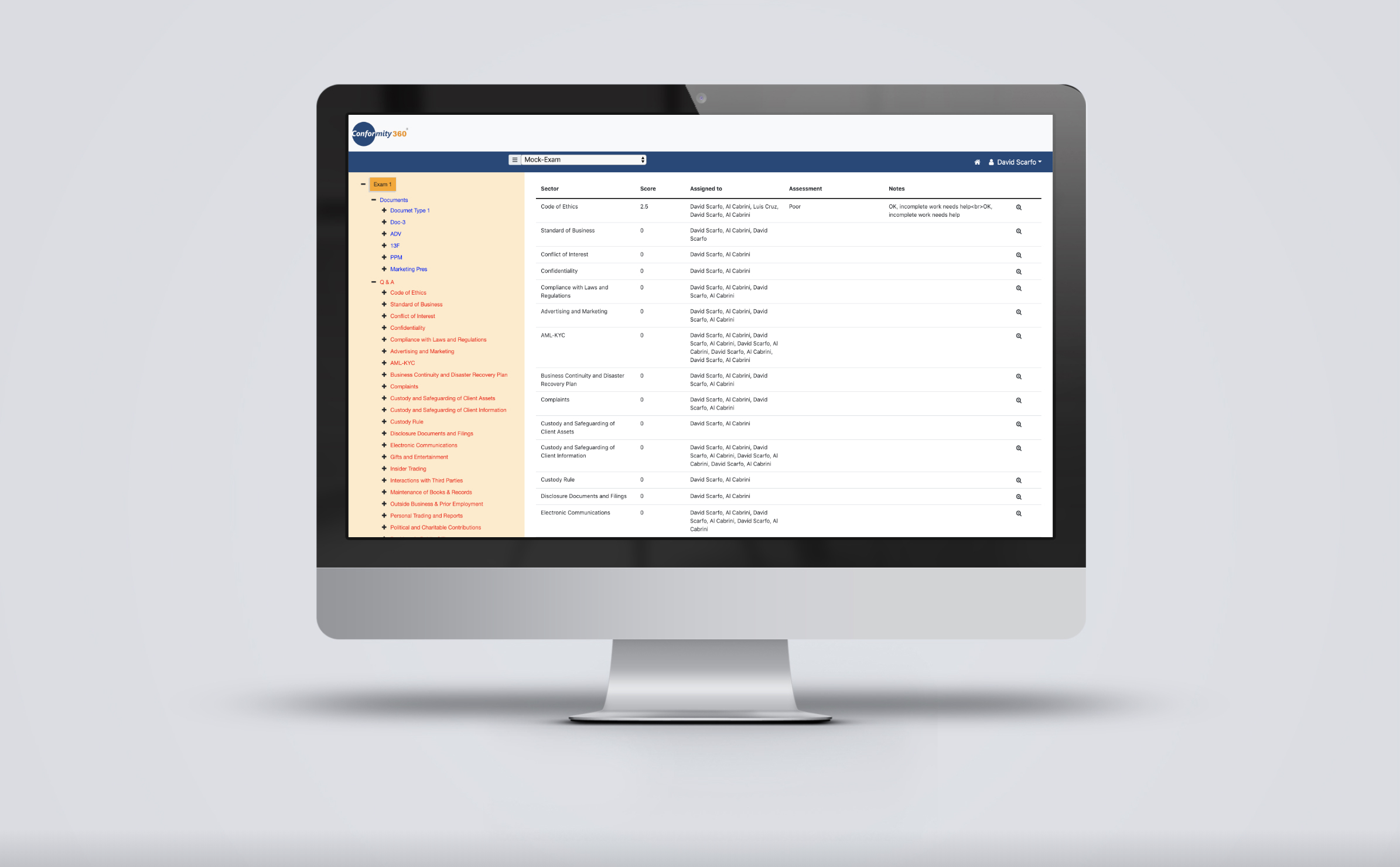

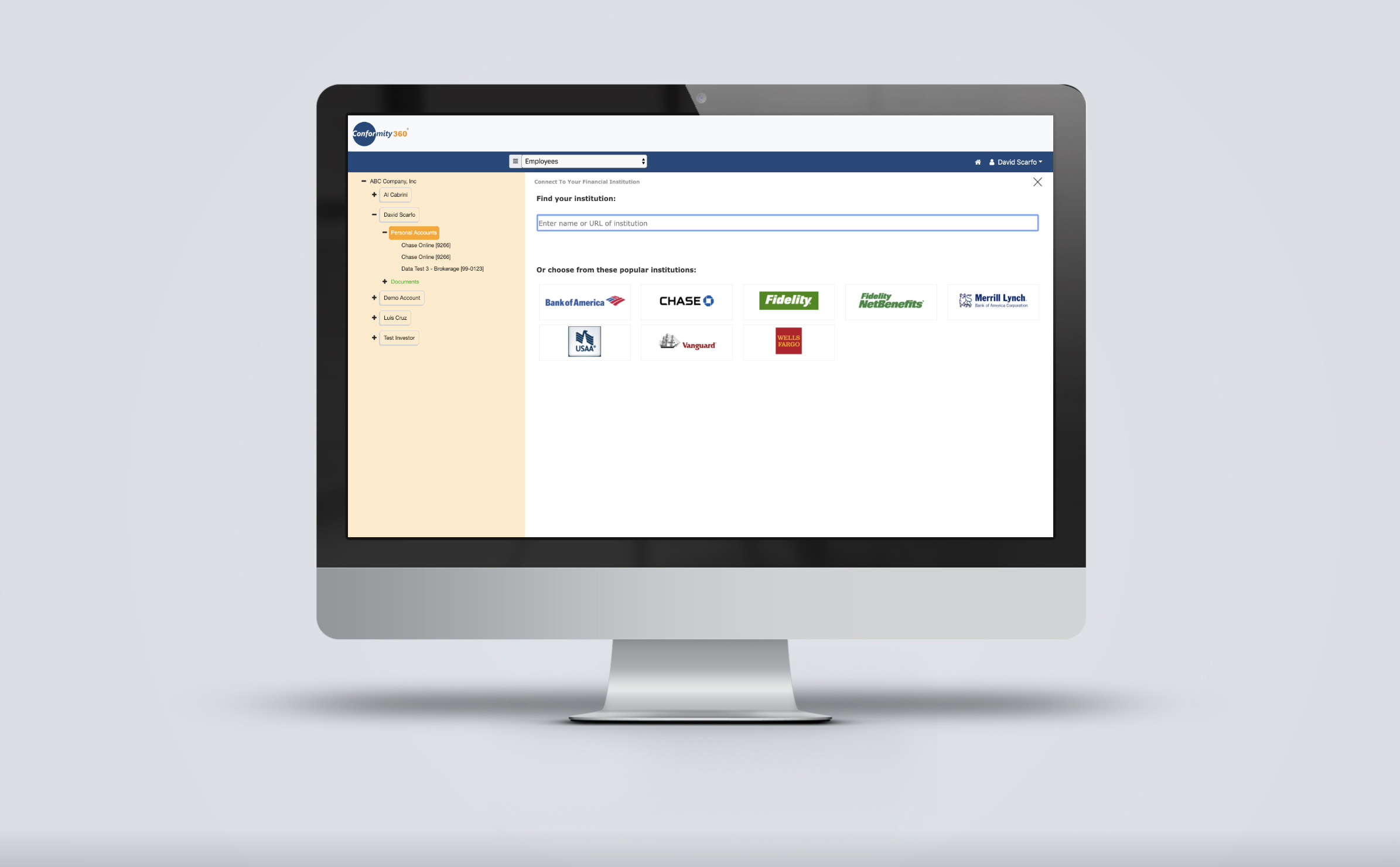

RuleBook is our web-based software that provides a risk-based approach to regulatory compliance by linking regulations to internal policies and risks and further maps them to business lines and products. It is a repository to organize regulations tasks and activities, personal trading statements, training, KYC/AML, books & records, mock-exams and a workflow for global regulatory change management. The system supports role-based security functions with centrally managed controls for access to regulatory content. RuleBook helps ensure that the regulatory affairs and compliance teams are always current on new regulations.